DAB History

Da Afghanistan Bank (DAB) was established in the capital, Kabul, with an initial capital of AFN 120,000,000, pursuant to Cabinet Approval No. 152, dated 23/04/1939, National Assembly Approval No. 11, dated 10/09/1939, House of Elders (Meshrano Jirga) Approval, dated 3/09/1939, and House of Lords (Majlis Ayan) Approval No. 5280, dated 6/02/1940. The Bank was authorized to establish its branches both domestically and abroad and to appoint sectoral banks as necessary.

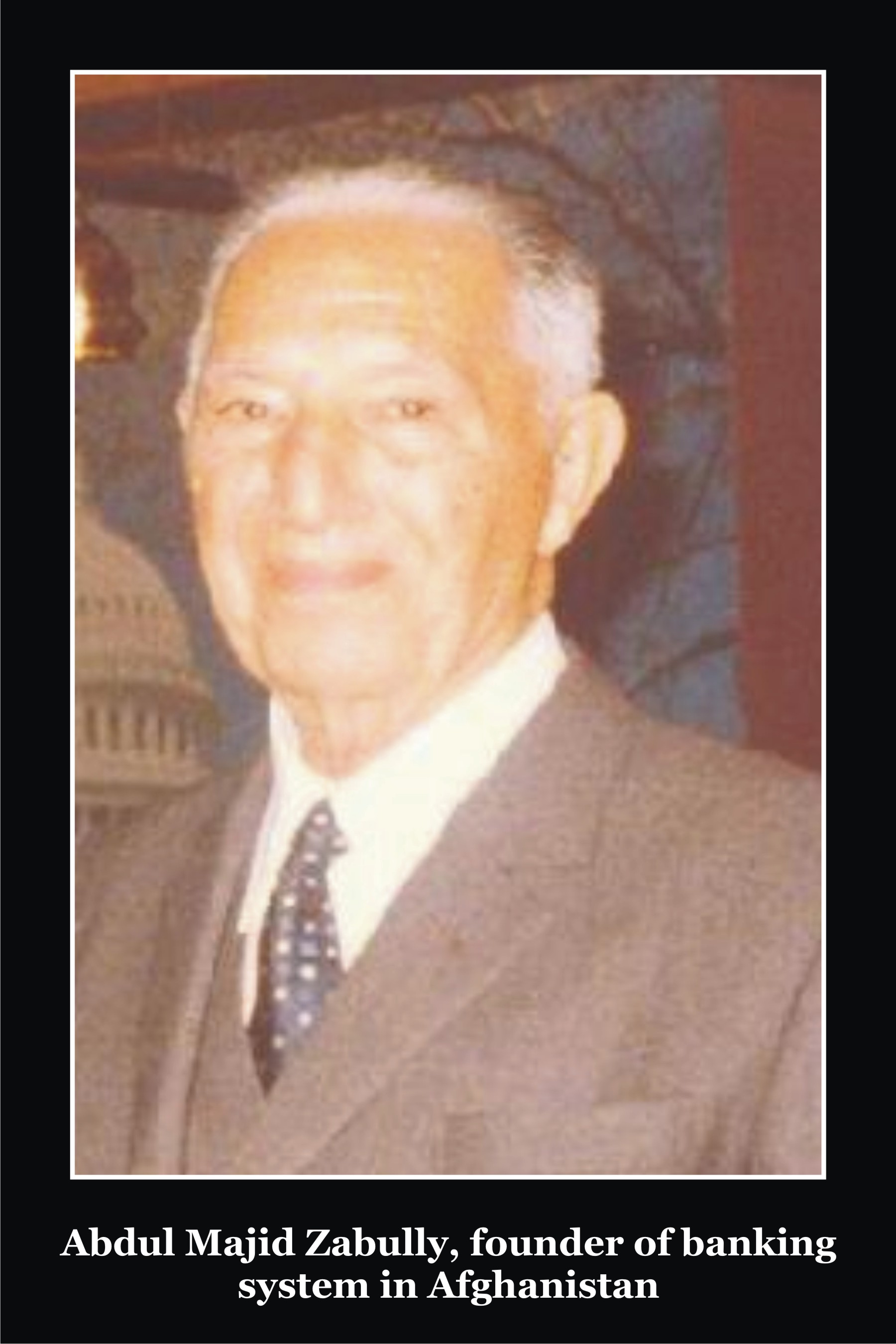

Afghanistan’s banking system began with the establishment of Bank-e-Millie Afghan in 1933, which handled government banking operations. After DAB’s establishment, state banking responsibilities were entrusted from Bank-e-Millie Afghan to this newly established bank.

Following the establishment of DAB, all government banking functions, including the printing and issuance of the Afghani banknotes, were transferred to this bank. Acting both as the government’s bank and as a commercial bank, DAB brought about significant and far-reaching developments, particularly in the printing and circulation of the Afghani, and achieved notable progress in shaping and developing the country’s banking system.

DAB’s activities can be divided into two phases. In the first phase, spanning 1939 to 2002, DAB was responsible for printing, minting, and issuing Afghani banknotes in response to market demand, maintaining the value of the national currency, and supporting government banking operations.

Alongside these responsibilities, the bank also conducted commercial banking activities, similar to those of other commercial banks in Afghanistan. These included opening savings, current, and time deposit accounts, extending loans to strengthen investments, and providing different types of credit to the commercial sector.

The second phase began in 1939, following the adoption of the Afghan Constitution. Under Article 12 of the Constitution, DAB was registered as an independent central bank and, with the authorities delegated to it, achieved notable accomplishments across various areas.

According to the DAB law, price stability is the primary and core objective of DAB. For this purpose, the development, implementation, and adoption of monetary policy, exchange rate policy, and foreign exchange arrangements, as well as the printing, minting, and issuance of banknotes and coins, have been assigned as core functions of the central bank.

In addition, as stipulated by law, DAB operates as the banker and financial agent of the government, serving as the authority responsible for issuing and registering business licenses for banks, money service providers, and foreign exchange dealers, as well as for securities-related services, and ensuring a safe and sound payment system.

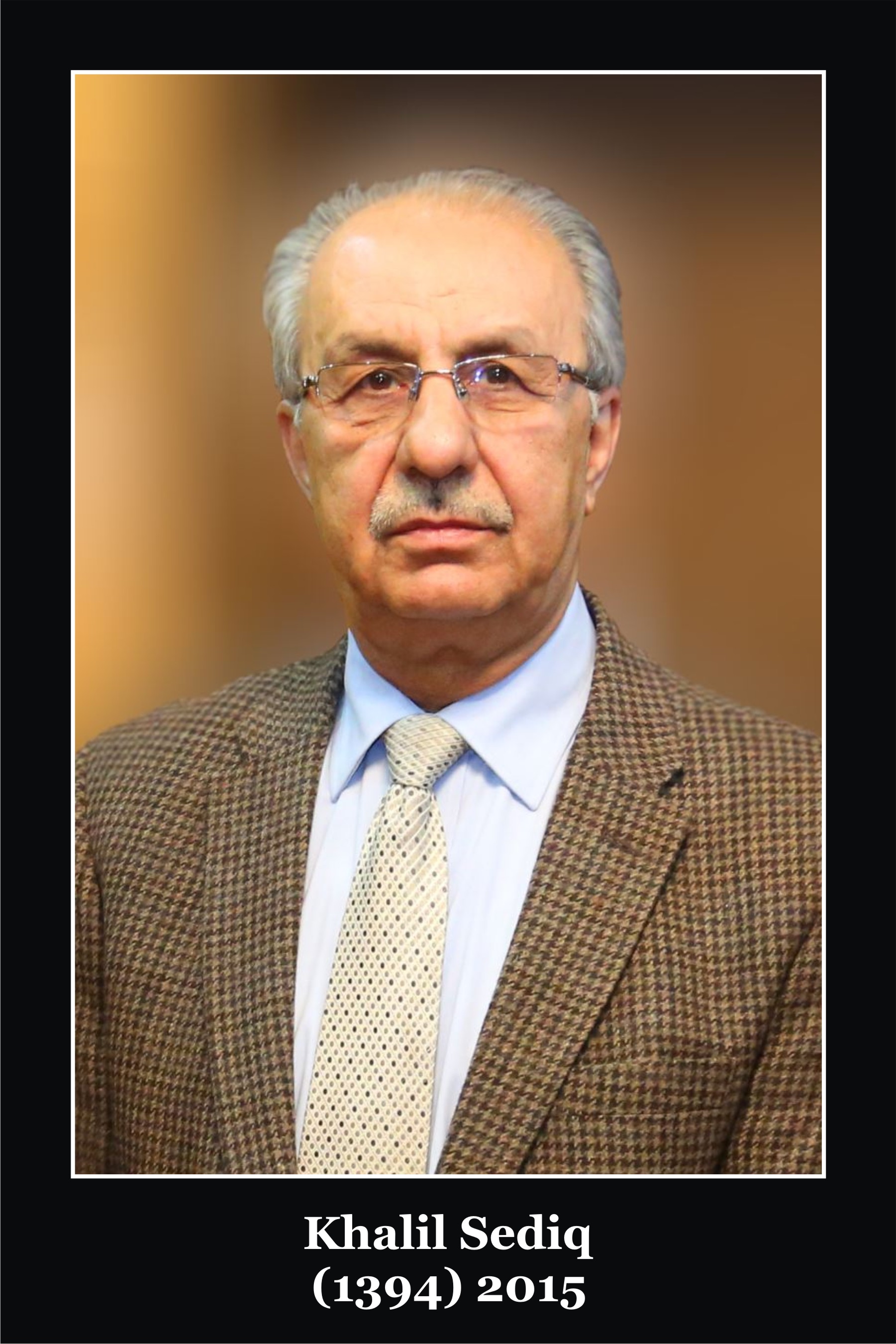

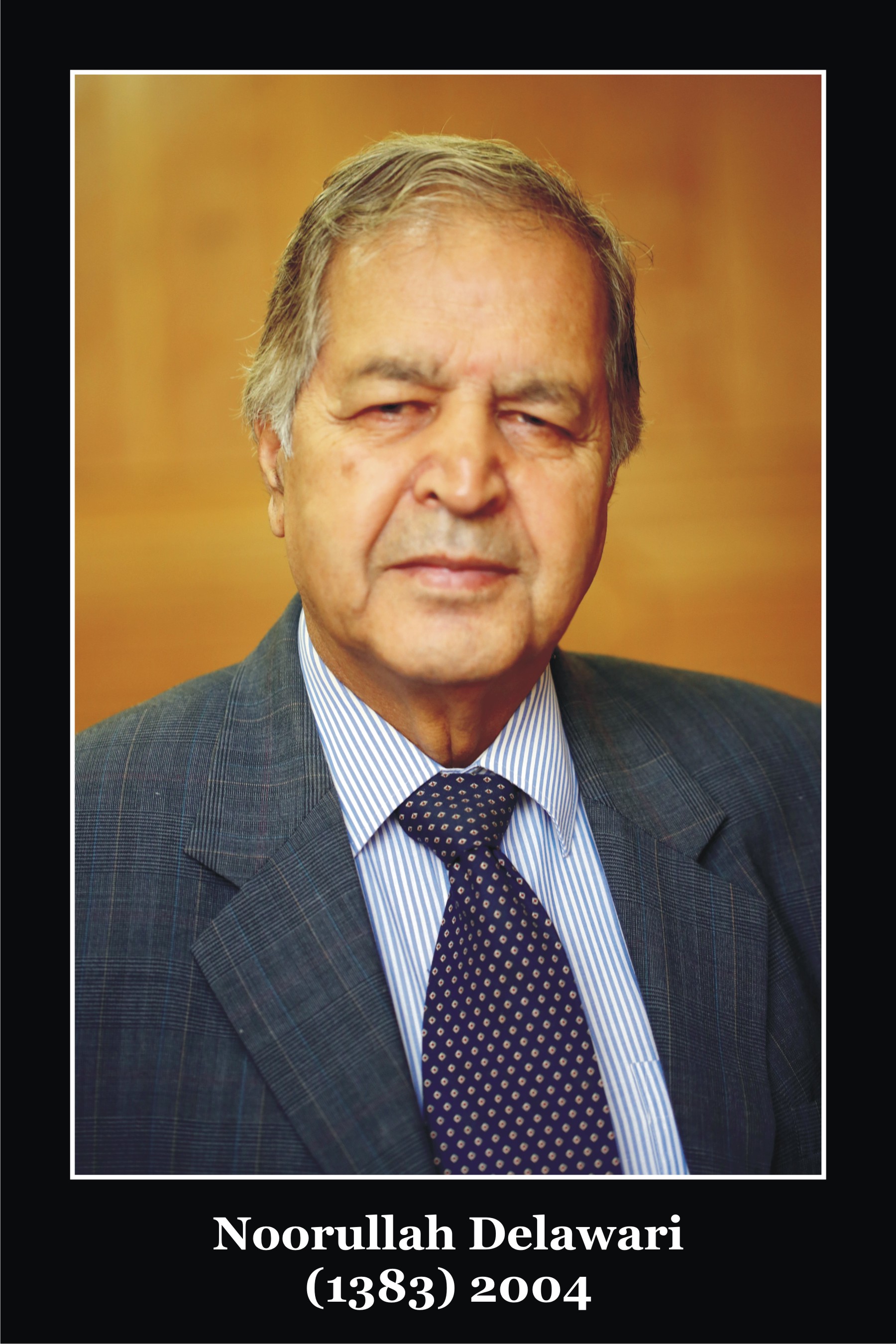

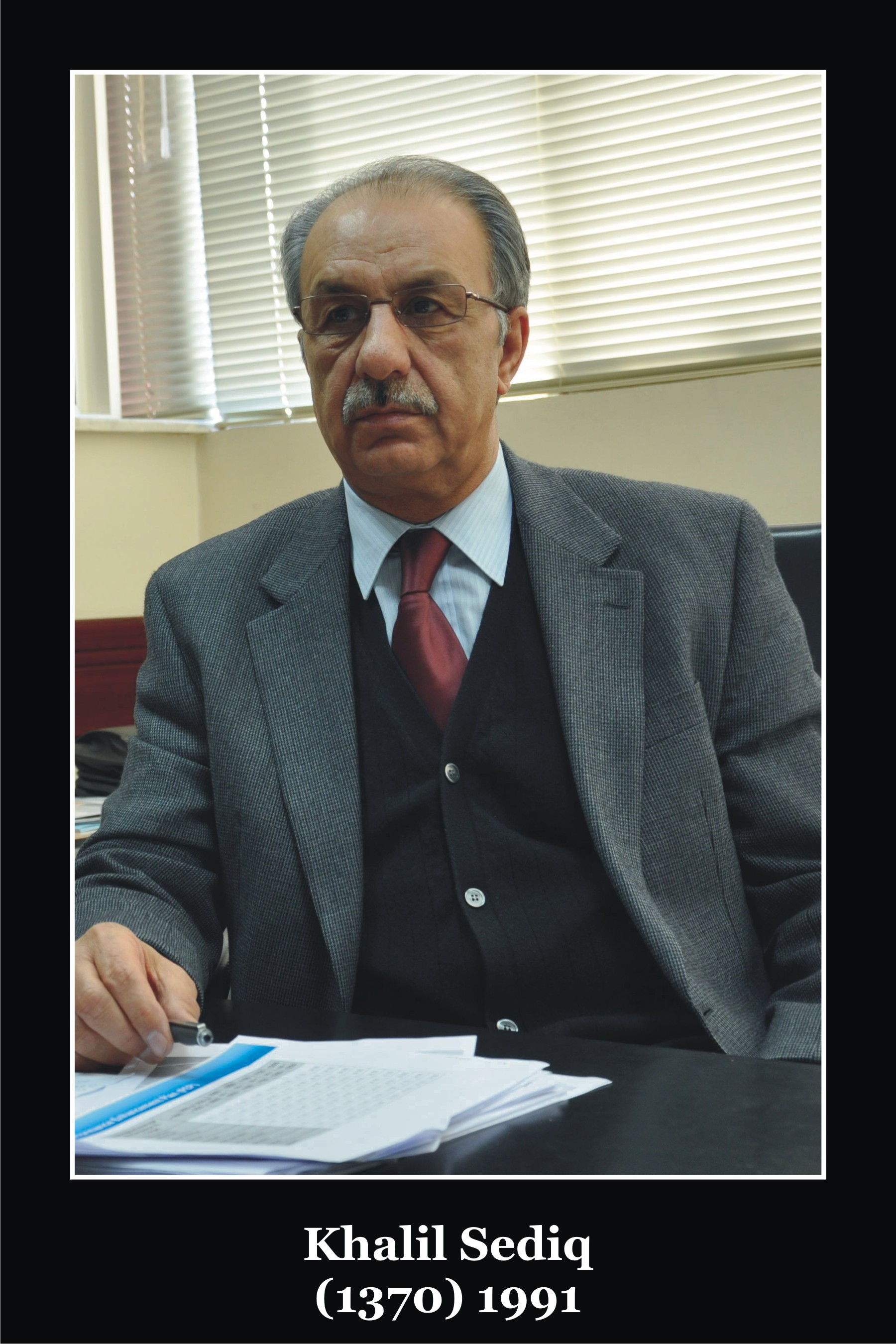

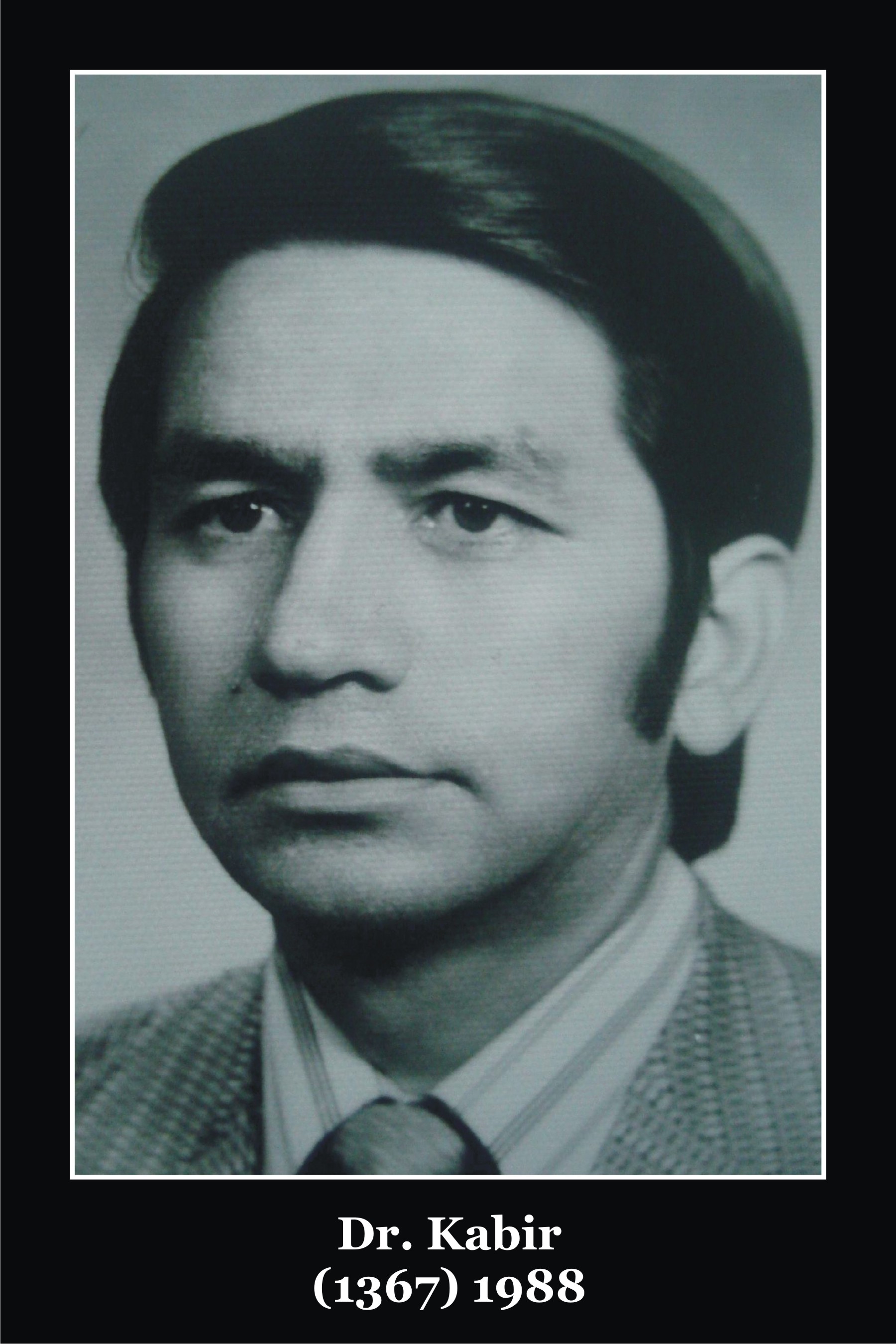

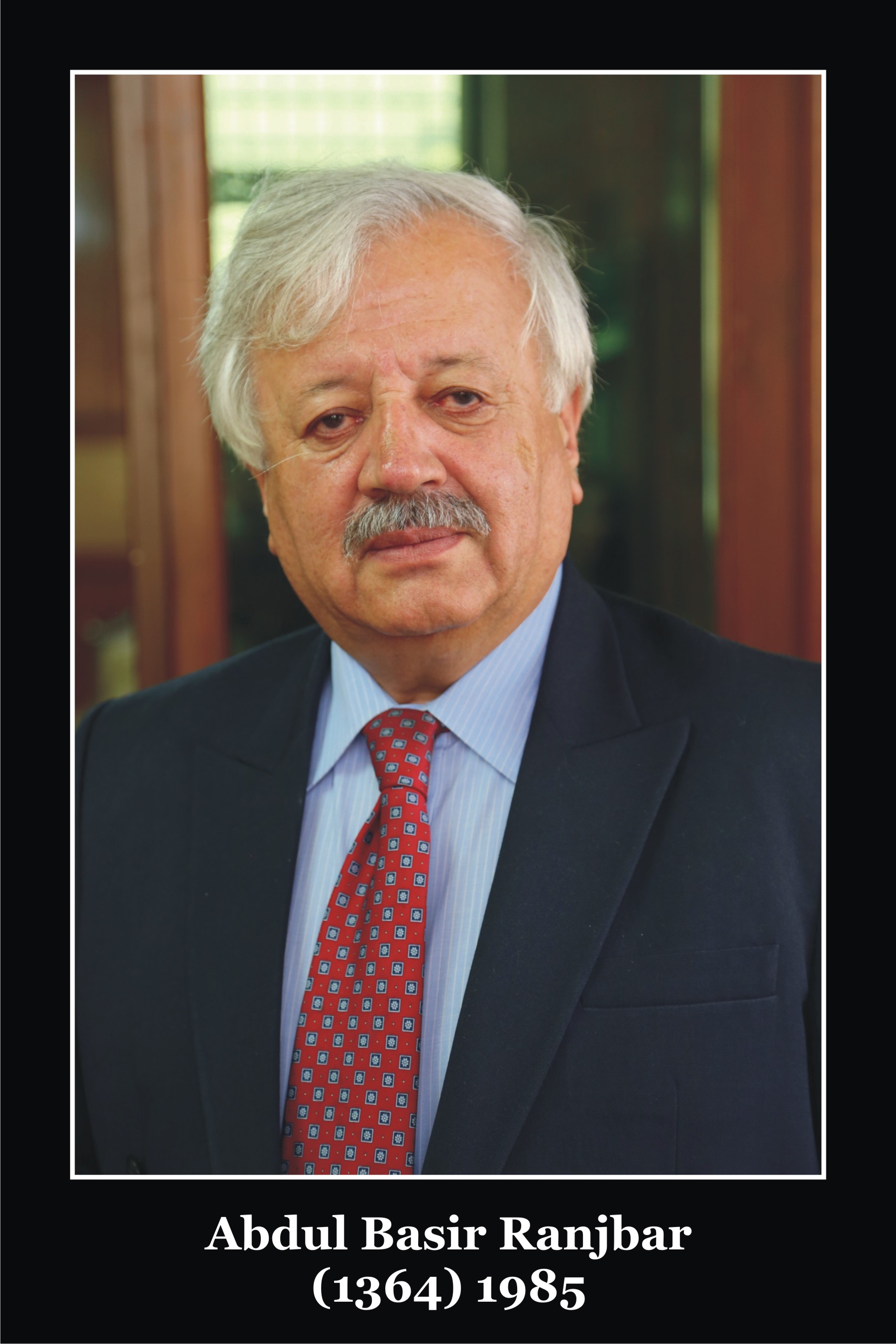

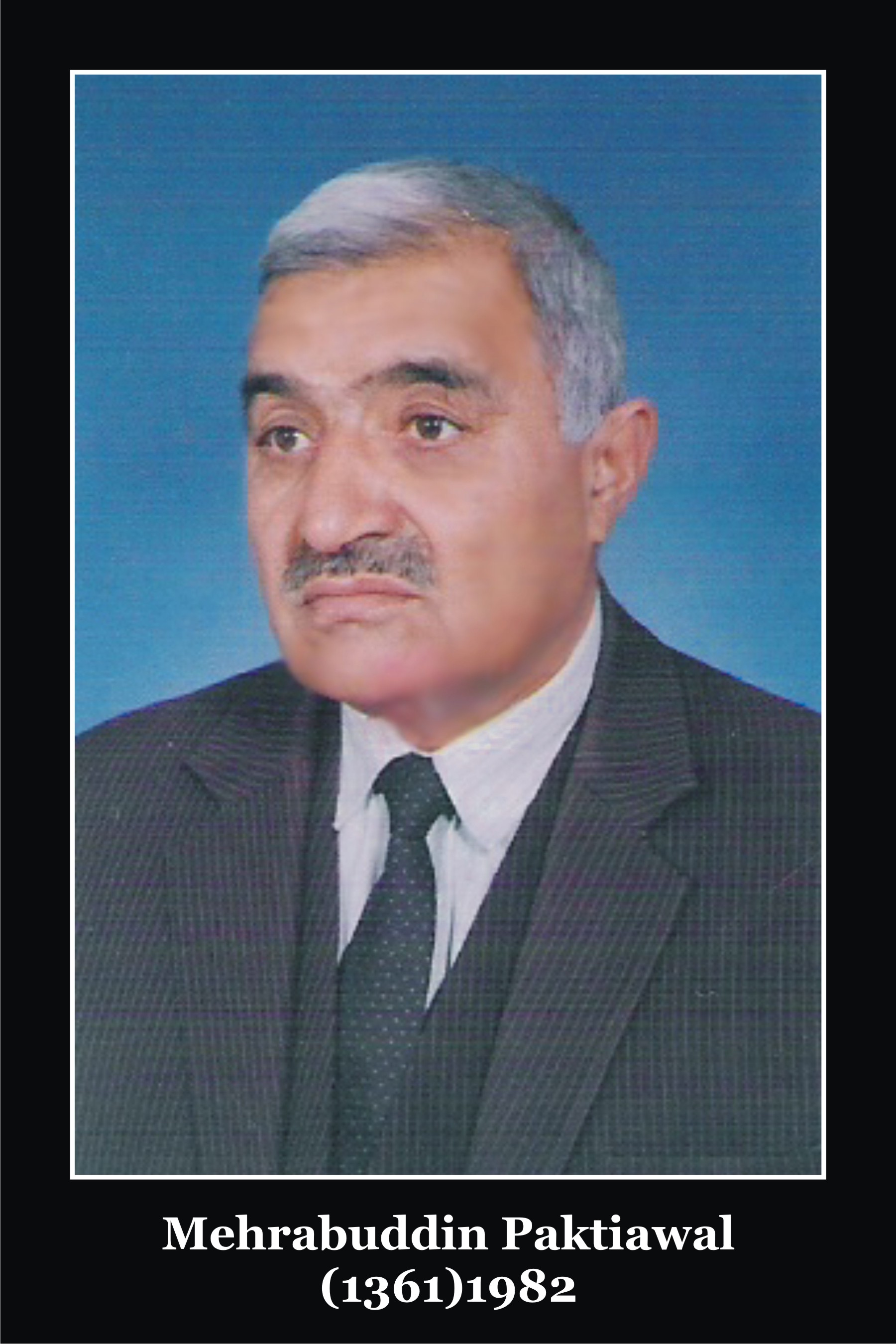

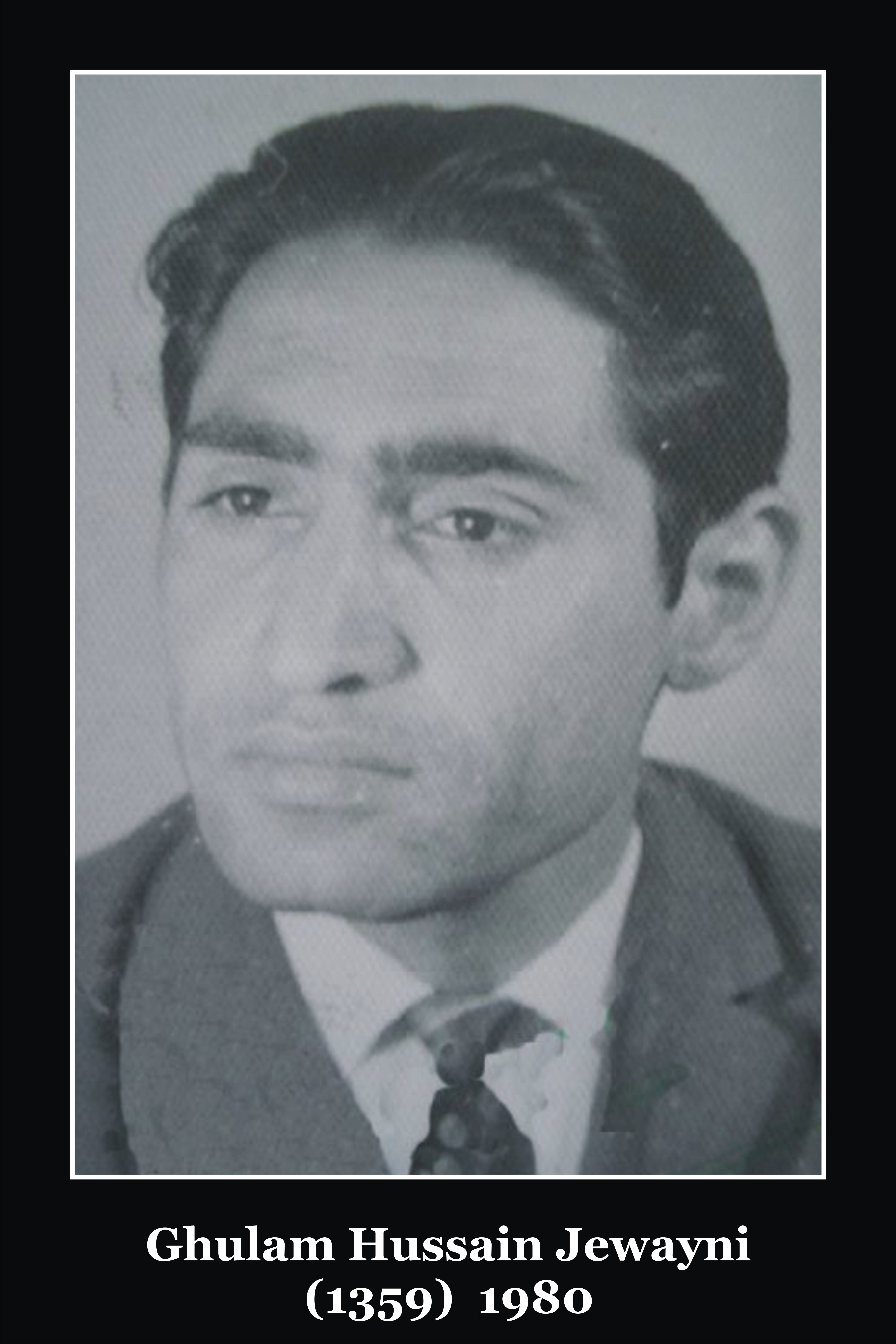

DAB Governors:

|

|

|

|

|

|

|

|

|

|

|

|